If you work with numbers for a living, “brand” can sound suspiciously like “feelings with a color palette.” Nice to have, sure, but not something you would put in the same sentence as return on equity or discounted cash flow.

The problem is that the data does not agree with that view. Over the past two decades, multiple independent sources have treated brand strength as a quantifiable asset and then tracked what happens to companies that invest in it. The short version: strong brands behave like a very boring superpower. They quietly compound.

Let’s walk through a few proof points, then connect them back to what this means for brand investment.

1. Strong brands beat the market, repeatedly

A long-running McKinsey study looked at how well managed, top ranked brands performed against the world market. Over a 14-year period, those strong brands outperformed the global market by 74 percent as measured by total return to shareholders.

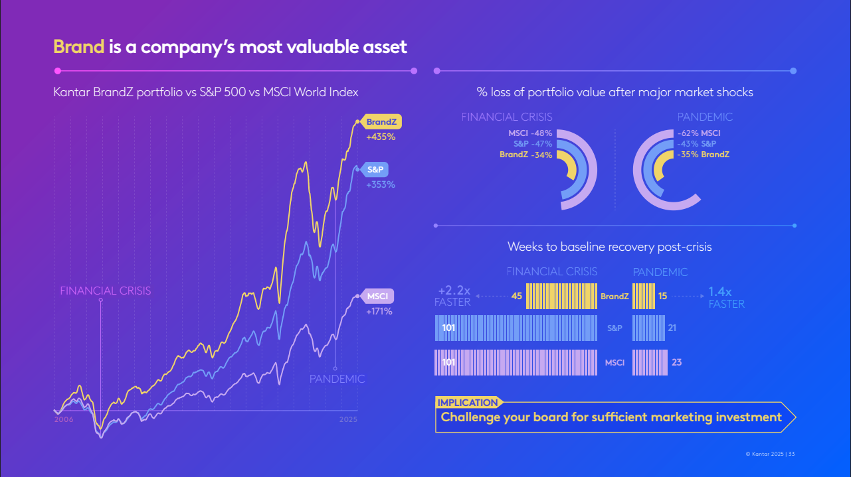

Kantar’s BrandZ analysis tells a similar story over a longer time frame. From 2006 to 2025, a portfolio of the world’s strongest brands grew its cumulative share price by roughly 435 percent, compared with 353 percent for the S&P 500 and 171 percent for the broader MSCI World Index.

This is not a marginal effect. It is hundreds of percentage points of additional value created over time for companies that put real money and discipline behind their brands.

Why this matters:

- Total return to shareholders (TRS) is one of the cleanest ways to see whether a company is creating value over time. When strong brands systematically outperform market benchmarks, it tells you that markets price brand strength as a real driver of cash flows, not as decoration.

- The spread versus broad indices suggests brand strength is not just correlated with “good companies.” It behaves like a structural advantage that compounds over decades, especially through volatility.

2. Brand value is now measured in trillions

Kantar’s 2025 BrandZ report values the global top 100 brands at 10.7 trillion dollars, up 29 percent year on year, even after recent economic shocks.

Brand Finance takes a similar approach, combining brand strength scores with financials to estimate brand value and help CFOs treat brand as an asset rather than a marketing slogan. Their methodology explicitly links three components: marketing investment, stakeholder equity, and business performance, in line with ISO 20671.

Again, that is not a creative director’s opinion. It is a measurable portion of enterprise value that rating agencies, investors, and finance teams track and model.

Why this matters:

- When brand value is measured in the trillions, it stops being “nice to have” and becomes part of the capital structure.

- Tying brand strength to business performance gives you a language that finance, strategy, and marketing can all use without rolling their eyes at each other.

3. Trust drives price premium and purchase behavior

Edelman’s trust research has been very consistent on one point. Trust is not a vague emotional benefit. It predicts whether people will buy from you and what they will pay.

In recent Edelman analysis:

- Trusted brands are seven times more likely to command a price premium.

- They also enjoy around a 14 percent higher propensity to be purchased.

- And 68 percent of consumers say that trust is more important to them now than it used to be when choosing brands.

That is before you get to the 40 percent of people who report dropping brands they previously liked because they no longer trusted the company behind them.

Why this matters:

- Price premium flows directly into margin. If you can hold price while competitors discount, or take increases without losing volume, your brand is doing visible work in the P&L.

- Higher purchase propensity translates into lower acquisition costs and better lifetime value. You spend less to convince people and more to serve them.

- The fact that trust levels have shifted over time shows this is not static. Brands that invest in credibility and consistency are buying future pricing power.

4. The effect is not just B2C

McKinsey’s work on B2B branding suggests otherwise. In one analysis, B2B companies with strong brands outperformed weak brands by about 20 percent on key financial performance metrics.

Brand Finance’s Brand Strength Index backs this up. Their scorecard for brand strength in any category, including B2B, includes awareness, consideration, reputation, acquisition, retention, market share, and price premium. Those inputs feed directly into the calculation of brand value and its contribution to business performance, not just “awareness for awareness’ sake.”

Why this matters:

- In categories where offerings are complex and differentiation is hard to explain, brand acts as a risk filter. Buyers lean toward names they trust to deliver and to keep their careers intact.

- A 20 percent performance gap in B2B often shows up in longer contracts, higher renewal rates, and the occasional ability to avoid a brutal RFP on the strength of reputation.

5. Resilience: brands as shock absorbers

It is one thing to talk about performance in normal conditions. The more interesting question is what happens in a crisis.

Kantar’s analysis of the 2008 financial crisis and the 2020 pandemic found that the strongest brands fell less, recovered faster, and ended up higher than both the S&P 500 and the MSCI World Index. Over the full period from 2006 to 2025, the BrandZ strong brands portfolio delivered 435 percent growth, while the indices lagged behind.

In plain language, when the market panics, strong brands still get punched in the face, just less hard. Then they stand up sooner.

Why this matters:

- Resilience is its own form of value. A portfolio that falls less and recovers faster reduces volatility and preserves optionality, which both investors and CFOs care about.

- For operating leaders, this resilience often looks like customers sticking with you during downturns, distributors prioritizing your products, or talent being slower to leave.

Bringing it together: why brand investment pays off

None of these statistics argue that a logo redesign on its own will unlock a 435 percent return. The data is more boring and more useful than that.

Across McKinsey, Kantar, Brand Finance, and Edelman, you see the same pattern:

- Strong brands systematically beat market benchmarks over long periods, sometimes by dozens of percentage points.

- Brand equity shows up in hard metrics like TRS, price premium, purchase propensity, and renewal rates, not just campaign awareness.

- Brands that invest consistently in equity weather shocks better, then compound faster when conditions improve.

In other words, brand is not the “soft” side of the business. It is an intangible asset that behaves a lot like any other productive asset. If you invest in it thoughtfully and measure it, it throws off cash.

So what does “brand investment” actually mean in this context?

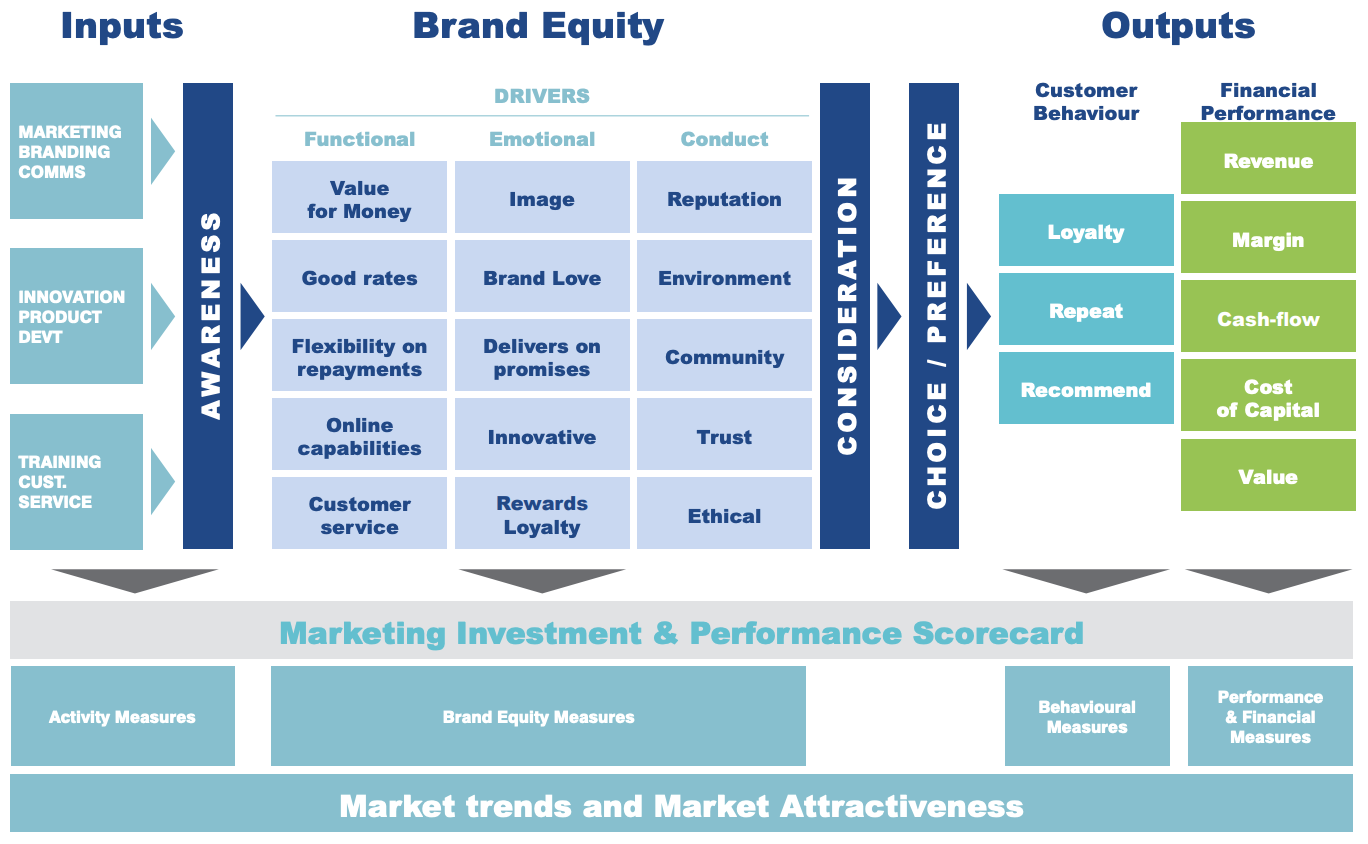

- Spending enough, consistently, to stay salient in your category, not just showing up when you need a quarterly boost.

- Building and maintaining trust through what you do, not just what you say, so that you earn price premium instead of buying volume with discounts.

- Treating brand metrics such as awareness, consideration, preference, and NPS as leading indicators that need to line up with lagging financial outcomes.

- Making clear tradeoffs about who you serve, what you stand for, and how you show up, so that you are genuinely different, not just louder.

If you like numbers, the takeaway is simple. The market has already priced in the value of strong brands. The question is whether you want that compounding to happen in your favor or in your competitor’s.

With over a decade of agency and in-house experience, Ben Huizinga is a creative and brand strategist focused on building brands that endure—crafting identities that make meaningful connections and stand the test of time. As Director of Brand and Creative at Young Marketing Consulting, Ben blends hands-on execution with high-level strategic thinking, helping organizations align their vision with the right voice, visuals, and experiences. He is also an experienced website architect, specializing in the development of beautiful, easy-to-use WordPress, Drupal, and Webflow sites that bring brands to life online. His work has shaped leading brands across the sustainability, technology, and nonprofit sectors—including Geothermal Rising, Echo Communications, and Bonterra, one of the world’s largest social good technology companies.

You might also be interested in these related articles:

AI has made content easy to produce, but harder to differentiate. Discover why creativity, judgment, and taste are becoming brands’ most powerful competitive advantages again.

AI search is rewriting how people find information, but not everyone is ready for the shift. Learn why the brands that win will be the ones that stay grounded, create real clarity, and avoid the noise surrounding GEO.